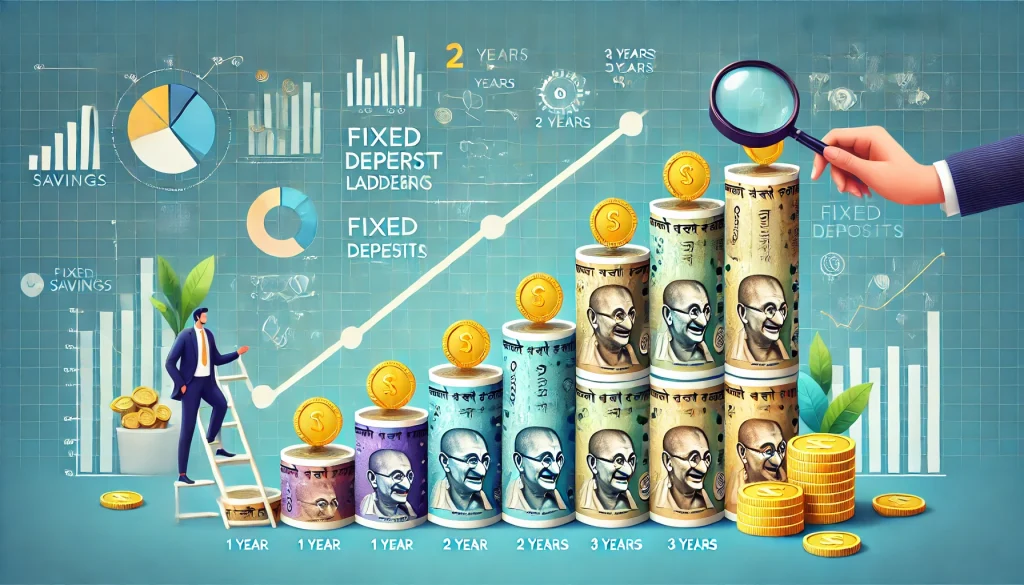

Fixed deposit laddering is an effective strategy to avoid the liquidation of long-term fixed deposits. It also helps depositors earn higher interest rates from a diversified fixed deposit portfolio. Investors can consider FD laddering to achieve a range of financial goals instead of depositing their entire corpus in a single FD. Learn about FD laddering in detail here to make informed decisions.

What Is Fixed Deposit Laddering?

Fixed deposit laddering refers to segregating your entire investable corpus across more than one fixed deposit with variable maturity tenure. It helps you earn a higher interest rate compared to a single fixed deposit invested for a longer tenure.

In addition, FD laddering allows depositors to invest their corpus across various banks and NBFCs offering a high interest rate. As a result, investors can earn better returns compared to a single FD in one bank or NBFC.

How Does Fixed Deposit Laddering Work?

Here is how FD laddering works:

- Decide Your Investment Horizon: To consider FD laddering, determine the time horizon of each FD based on your short-term and long-term financial goals.

- Segregate Your Investment Amount: Based on your financial needs, divide the total corpus into multiple segments. The corpus of each FD might or might not be equal.

- Select Maturity Tenure: Determine the maturity period and the amount you want to invest for each tenure depending on your goals.

- Ensure Consistency: Continue investing in multiple fixed deposits to maintain the FD ladder.

Example to Understand Fixed Deposit Laddering

Consider the following example to understand fixed deposit laddering. Let’s say you plan to deposit ₹3 lakhs in a fixed deposit. You can either book an FD of ₹3 lakhs or consider FD laddering by splitting the amount into multiple fixed deposits. This helps you book fixed deposits for variable tenures with different interest rates. Here is how you can split the fixed deposit of ₹3 lakhs:

Fixed Deposit 1: You can book an FD of ₹1 lakh for 1-year tenure at 7.05% p.a. The total amount receivable at maturity with interest is ₹1,07,050.

Fixed Deposit 2: You can open an FD with a principal ₹50,000 for 2 years at 7.50% p.a. The maturity amount, including the principal and interest, will be ₹57,781.

Fixed Deposit 3: You can open a fixed deposit of ₹80,000 for 2 years with another bank at 8.05% p.a. The amount receivable at maturity will be ₹93,398.

Fixed Deposit 4: You can book a fixed deposit amounting to ₹70,000 for 3 years at 8.50% p.a. The final amount receivable at maturity is ₹89,410.

The total interest that you will receive from these four fixed deposits is ₹47,639.

Instead, if you had booked a single fixed deposit of ₹3 lakhs for 2 years at 7.00%, the total interest earned will be ₹43,470. In addition, if you need to withdraw the fixed deposit before maturity, you will have to pay a penalty on the effective interest rate. Another disadvantage of a single deposit is that you don’t have the flexibility to take advantage of improved interest rates.

However, if you have multiple fixed deposits, you can liquidate one fixed deposit of the required amount with a lower interest rate. Thus, fixed deposit laddering helps you reduce your interest loss and avail the best available interest rates in the market.

Benefits of Fixed Deposit Laddering

Here are the benefits of FD laddering:

- Enhanced Liquidity: FD laddering helps you liquidate a fixed deposit with near maturity or lower interest rate for financial emergencies, ensuring relatively less loss of interest.

- Reduced Reinvestment Risk: You can reinvest your FD amount at the current interest rate to avoid potential risks related to long-term FDs.

- Optimised Returns: You can diversify your corpus across different fixed deposits with varying maturity dates. This helps you reap the benefits of different interest rates for varying tenure. Additionally, you can reinvest the maturity amount at the prevailing rates within short notice.

- Addressing Interest Rate Risk: FD rates fluctuate frequently. Instead of being locked at lower interest rates, you can consider laddering to get the flexibility of availing newer rates at any time. As the rates rise, you can keep booking new deposits.

- Encouraging Financial Discipline: FD laddering helps you manage your corpus based on your financial goals while discouraging impulsive withdrawals. This boosts your financial discipline as you ensure to stay invested and avoid unnecessary expenses.

- Tax Efficiency: Segregating the FD investment amount with different maturity tenures can help you reduce your taxable interest income during a financial year. This optimises taxation and ensures efficiency while multiplying your wealth. For maximum efficiency, you can use a fixed deposit ladder calculator to plan your investments.

Things to Consider to Devise Fixed Deposit Laddering Strategy

Make sure to consider the following factors for FD laddering:

- Maturity Period

While considering FD laddering, ensure you distribute your corpus across various tenures with short-term, medium-term and long-term maturity.

- Interest Rate Variations

Anticipating FD interest rates can help you book fixed deposits when the rate is high. Consider the fluctuations in the FD rates and book your fixed deposit when banks offer a higher interest rate.

- Financial Goals

Determine your financial goals whether it’s income generation, wealth accumulation or capital preservation. Based on your goals, devise a suitable FD laddering strategy.

- Diversification

You can book fixed deposits with multiple banks or NBFCs to diversify your corpus. This helps you avail variable interest rates.

- Tax Implications

While devising an FD laddering strategy, consider the tax implications. Interest income from fixed deposits is taxable based on your income slab. By distributing your corpus with different maturity periods, you can optimise tax efficiency.

- Liquidity Requirements

Deposit a certain amount of your corpus for a short term. This helps you avoid premature closure of long-term fixed deposits and imposition of penalty on the effective interest rate.

- Reinvestment Options

Devise reinvestment strategies for each FD that you book with FD laddering. This helps you grow your corpus in a planned way.

- Monitoring and Review

Ensure to keep monitoring fixed deposit interest rates at regular intervals to determine your FD laddering strategy effectively.

Final Words

Fixed deposit laddering helps depositors plan their finances while preventing impulse withdrawals. Premature withdrawal of fixed deposits attracts a penalty chargeable by banks. To avoid such penalties from affecting gains, depositors should use an FD laddering strategy while investing their money. This way, they can maximise the liquidity of their investments to cover their financial needs.

A. The minimum amount of booking a fixed deposit varies between banks and NBFCs. However, certain banks offer a minimum fixed deposit booking amount of ₹1,000 for depositors.

Banks allow premature fixed deposit liquidation in case depositors face emergencies. However, they charge a penalty on the effective interest rate during premature withdrawal of fixed deposits.

A. Resident Indians, sole proprietors, limited companies, partnership firms, Hindu Undivided Families (HUF), group companies, family trusts, associations, clubs, societies and minors under the guardianship of parents can open a fixed deposit.