Fixed deposits are a popular investment option due to their guaranteed returns and low risk. In FDs, you invest a certain amount for a fixed tenure at a fixed interest rate; hence you get a stable return after maturity. But what if there’s a hike in the interest rates after you have invested your money?

It means you must give a thought to the inflation trajectory. We are well aware of RBI increasing or decreasing the interest rates as per the inflation. If inflation is rising, interest rates are also raised and vice-versa. The return on your FDs is also inversely proportional to this interest rate. When you make an investment that will lock in your money for a long period, you would want a better interest rate and return. If the interest rates after your investment rise, you might have an opportunity loss. And to optimise for better returns in fixed deposits and minimise loss, FD laddering comes in place.

Let’s look at what FD laddering is and how it works.

What is FD Laddering?

Fixed deposit laddering is a strategy where an investor divides the funds into multiple FDs with different tenure and interest rates. It’s basically creating a ladder of maturity dates.Here, investors invest in multiple FDs rather than investing a lump sum amount in a single FD. This single strategy can help you optimise your FD returns better and enjoy liquidity at regular intervals.

How Does FD Laddering Work?

With FD laddering, the main idea is to re-invest the mature FDs for another tenure at higher returns. It eventually helps you avoid locking your money for the long term at a fixed interest rate, and you also benefit from the power of compounding.Instead of investing your entire amount in one FD, you divide the amount equally and invest in multiple FDs with different tenures. Let’s take an example to understand how laddering works: If you want to invest Rs. 3 lakhs in any FD, you will divide it into three different FDs with maturity periods of 1, 2 and 3 years.

| Principal Amount | Tenure | Applicable Interest Rate |

| Rs. 100,000 | 1 Year | 7.45% |

| Rs. 100,000 | 2 Year | 7.55% |

| Rs. 100,000 | 3 Year | 7.65% |

As each FD reaches its maturity date, the investor can choose to either reinvest the amount into a new FD or utilise the funds as needed. This way, the investor enjoys regular income from the interest earned on the maturing FDs while having access to liquidity from the matured ones.

What are the Benefits of FD Laddering?

- High-Interest Rate: With FD Laddering, you can take advantage of varying interest rates at different times. If interest rates are high when a particular FD matures, you can reinvest at those attractive rates.

- Better Liquidity: With laddering, one of your FDs would be maturing every year, ensuring liquidity at regular intervals. It helps to meet short-term financial needs without breaking FDs and paying any penalty.

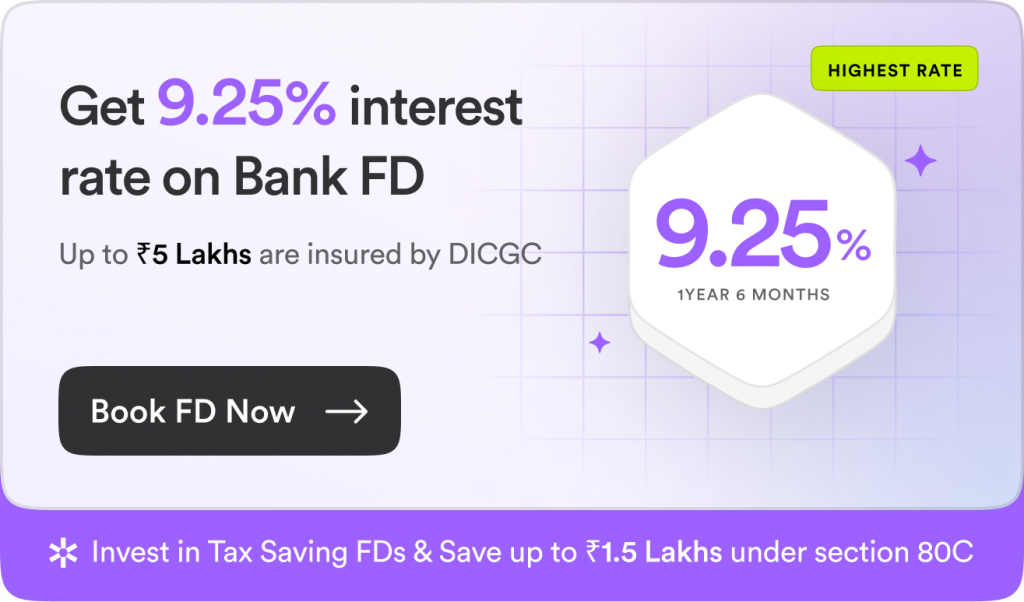

- Risk Mitigation: By diversifying your FDs across financial institutions, you can reduce the risk of dilution by keeping all your money in one FD. Also, FDs are insured up to Rs. 5 lakh by DICGC.

FD Laddering is a straightforward strategy that doesn’t require complex financial knowledge. Anyone, including first-time investors, can easily manage it.

What are the Disadvantages of FD Laddering?

- Lower Returns in Falling Rate Scenario: In a declining interest rate environment, the new FDs may offer lower returns compared to the earlier ones, leading to reduced overall income.

- Taxation: The interest earned from your FDs is taxable as per your income tax slab rate. Laddering might reduce your effective returns, especially if you fall in the higher tax brackets. You might have to pay TDS on FD if the interest exceeds Rs. 40,000 in a financial year.

- Opportunity Cost: While FDs are secure, they might not provide the same level of returns as riskier investment options like equities or mutual funds.

Factors to Consider Before Opting for FD Laddering

- Financial Goals: Assess your short-term and long-term financial goals to determine the ideal investment tenure for each FD.

- Interest Rate Trends: Keep an eye on the interest rate trends to strategise the timing of your FD Laddering.

- Emergency Fund: Ensure you have a separate emergency fund before implementing FD Laddering to handle unforeseen expenses.

- Laddering Period: Decide the frequency of laddering (e.g., yearly, half-yearly) based on your financial requirements.

Why Should You Opt for FD Laddering?

FD Laddering offers a balanced investment approach, combining the safety of FDs with the potential for higher returns. It provides a reliable source of income while maintaining flexibility. This strategy particularly appeals to risk-averse investors seeking steady returns over time.

Conclusion

Fixed deposit laddering is a time-tested investment strategy that offers a secure and organised approach to growing your savings while ensuring liquidity. You can optimise interest rates and minimise risks by distributing your investments across FDs with different maturity periods. It is a suitable option for individuals looking to strike a balance between safety and returns. So, if you want to maximise your earnings without compromising financial security, FD Laddering could be an ideal choice for you.

FAQs

No, FD Laddering is also a viable option for investors who want to diversify their portfolios while preserving capital and generating regular income.

The minimum investment required for FD Laddering varies among banks and financial institutions. It’s essential to check the specific requirements of the institution where you plan to open the FDs.

The minimum investment required for FD Laddering varies among banks and financial institutions. It’s essential to check the specific requirements of the institution where you plan to open the FDs.

Yes, most banks allow premature withdrawal of FDs in case of emergencies, but it typically incurs a penalty that affects the interest earned.

While FD Laddering provides stable returns, it might not fully protect against inflation’s eroding effects over the long term. It is advisable to diversify your investment portfolio to combat inflation.

Yes, NRIs can invest in FDs in India, and thus, they can also implement FD Laddering to optimise returns and manage liquidity.

Disclaimer

This article is solely for educational purposes. Stable Money doesn't take any responsibility for the information or claims made in the blog.