India Post or DOP has been the backbone of India’s communication for 150 years. Besides delivering mail and post, this Indian institution offers numerous small savings schemes like FD, RD, etc. Post office tax saver fixed deposit is a risk-free investment option which will provide assured returns along with tax benefits. To explore more about it, keep reading.

Interest Rates on Post Office Tax Saving FD 2024

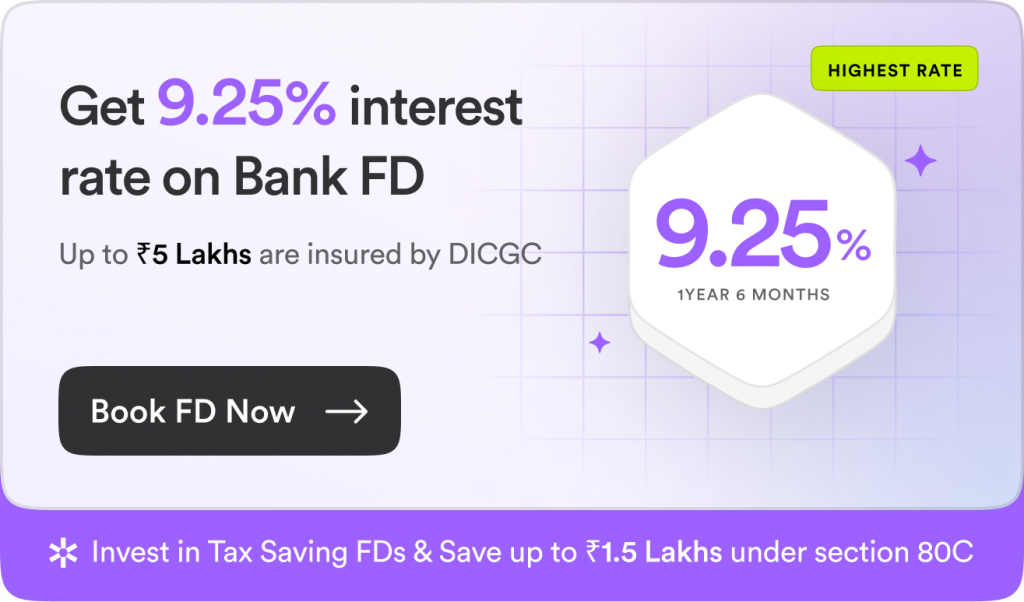

The interest rates applicable on Post Office fixed deposits generally start from 6.9%. Under Section 80C of the Income Tax Act, of 1961, investments made in these fixed deposits for a tenure of 5 years are eligible for tax deductions up to a specified limit. During this tenure, these FD schemes offer a 7.5% interest rate to account holders along with tax benefits.

Features Of Post Office Tax Saving FD

Below are the following features of a post office tax-saver fixed deposit account:

| Account type | Time Deposit (TD) |

| Minimum Amount | ₹1,000 |

| Maximum Amount | NIL |

| Minimum Tenure | 1 year |

| Maximum Tenure | 5 years |

| Premature Withdrawal | Available after 6 months from the date of deposit |

| Loan Facility | Not available |

| Nomination Facility | Available |

Post Office Tax Saving FD Interest Calculator

Anyone can easily calculate the post office tax saver FD interest rate by using the below-mentioned compound interest formula.

Formula

Maturity Value = Principal * (1 + Interest Rate/4)^(n*4)

Here,

- N= the number of years

- The interest rate must be the annual rate.

Note: The above-stated formula is for interest compounded quarterly.

Calculation With Example

For instance, you want to deposit ₹1 lakh at the interest rate of 7.8% for 5 years.

As per the formula,

Maturity value = 1,00,000 * (1+.078/4) (5*4) = ₹1,47,145.

How to Open a Post Office Tax Saving FD Online?

In case you are searching for a step-by-step guide on how to open a post office tax-saver fixed deposit account, read below.

- Step 1: Visit the official net banking portal of the Post Office.

- Step 2: Enter your login credentials to log in successfully.

- Step 3: Tap on the ‘General Services’ option.

- Step 4: Click on the ‘Services Request’ option.

- Step 5: Click on the ‘New Request’ option.

- Step 6: Select the account type you want to open.

- Step 7: Fill up the application form with a few details.

- Step 8: Hit the ‘Submit’ button.

Once you go through the above steps, the post office will initiate your request to open a post office FD tax saver account online.

Eligibility to Open Post Office Tax Saving FD Scheme

You can easily open a post office tax saver fixed deposit by meeting the below-stated three eligibility criteria.

- Indian Residents above 18 years

- Minors above 10 years (account operated by the parent)

Note: NRIs (non-resident Indians) are not allowed to open tax-saver FD post offices.

Documents Required for Opening a Post Office Tax Saving FD Scheme

You must keep all the following documents handy to ease your tax saver fixed deposit account opening process in the Indian Post Office.

1. Identity proof

- Aadhaar Card

- Voter ID Card

2. Address Proof

- Utility Bills (water bills, electricity bills, etc)

- Ration Card

3. Other Documents

- PAN Card

- Two Recent Passport-Size Photographs

Benefits of Post Office Tax Saving FD Scheme

With a post office tax saver fixed deposit account, you will get to enjoy various benefits such as the following:

- There is no maximum deposit amount stated by the post office. This allows FD account holders to deposit funds according to their financial standing and goals.

- The interest calculation and payouts are done on a quarterly and annual basis respectively, offering you steady interest income.

- Both nomination and premature withdrawal facilities are available.

- Post office offers a wide array of maturity options to choose from.

- The account renewal option is also available.

- You can open as many post office tax saver fixed deposit accounts.

- If needed, you can change your single account to a joint and vice versa.

- Post Offices in India allow its customers to transfer the tax saver FD account from one branch to another.

- The post office tax saver FD interest rate is much higher than the FDs offered by most Indian banks.

Terms and Conditions of Post Office Tax Saving Scheme

Go through the given list of terms and conditions that you must be aware of before opening a post office tax-saver fixed deposit.

- You have to deposit a minimum amount of ₹1,000.

- FD accounts with 5 years of maturity are only eligible for Section 80C tax deduction.

- In case the tax earned on your tax saver FD account exceeds ₹40,000 in a financial year, the tax might get deducted by the post office.

- You can opt for the premature withdrawal option 6 months from the date the account was opened.

Final Word

Apart from online opening a post office tax saver fixed deposit account, you can open it through offline modes. Visit the nearest post office and collect the application form. In case of any doubt, you can take assistance from any of the officers present in the post office. Now that you know all about FD tax saver accounts in the Post Office, open one now.

FAQs

The interest income of senior citizens accrued from post office tax saver fixed deposit will be tax-exempt up to ₹50,000 under Section 80 TTB.

Yes, the post office allows their account holders to renew such accounts for another year after your account’s maturity period. However, you have to extend the account with 6 months, 12 months and 18 months of maturity for 1 year TD, 2 years TD, and 3 and 5 years TD respectively.

Yes, you can transfer your account by submitting an application form along with the acceptance letter from the pledgee.

Disclaimer

This article is solely for educational purposes. Stable Money doesn't take any responsibility for the information or claims made in the blog.