How a Gold Bond Works: Everything You Need to Know

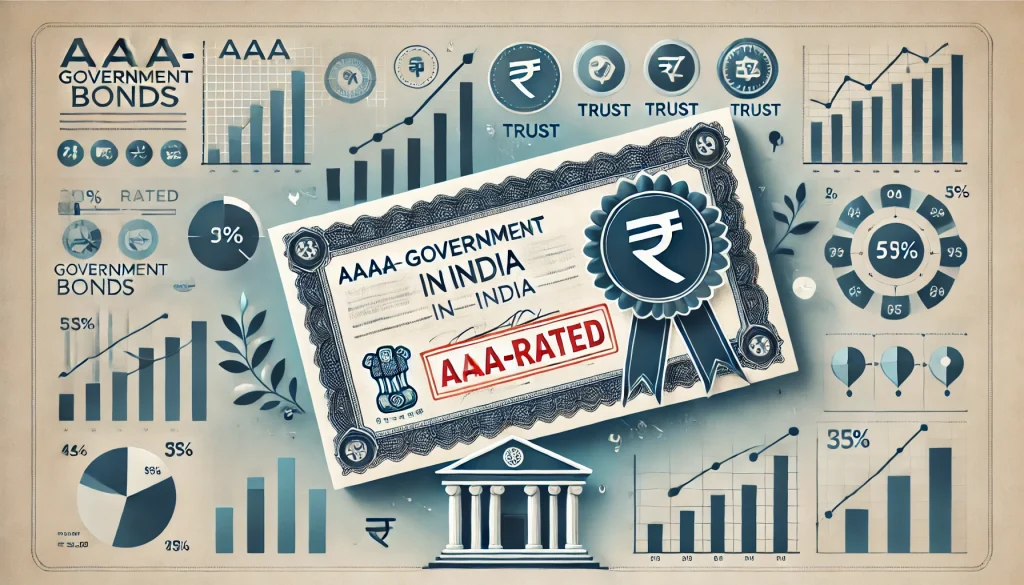

Gold bonds are one of the safest investment options for Indian investors. As a government-issued investment instrument, it ensures security while paying out periodic interest to the investors. Investing in gold bonds can help you avail tax benefits to reduce your taxable income. Learn how a gold bond works before you purchase it to reap …

How a Gold Bond Works: Everything You Need to Know Read More »