A bond is a debt investment where the investor lends money to a company or government and earns interest. Yield curve analysis is essential for predicting the interest and profit of bonds. Understanding these curves helps in making informed investment decisions for maximum returns. This blog discusses the types of yield curves, their meaning, their use by investors, and the factors that influence them.

What Is a Yield Curve?

A yield curve is a graph depicting interest rates on debt for various maturities. It illustrates the expected returns for investing money over a specified time. The vertical axis represents bond yield, while the maturity time is on the horizontal axis.

Investors use the curve to predict returns when lending money. The curve’s shape can vary. It helps investors discern the interest rate difference between short-term and long-term government bonds.

An inverted bond curve signals an economic downturn, aiding risk assessment. Companies analyse yield curves to decide whether to hold bonds until maturity. The curve predicts future interest rate changes and economic activity based on its slope.

Yield Curve Working

Interest rates on bonds with different maturities from the same issuer vary depending on investor sentiment, market trends and economic performance. The yield curve visually depicts these rates and helps investors create their investment strategies.

Long-term bonds carry the risk of rising rates, and the yield curve helps assess that risk by showing short, medium and long-term bond yields on a single chart. Short-term rates are typically lower because of lower risk, and the yield curve represents the risk premium investors expect for longer-dated securities.

A steeper curve indicates a higher difference between short-term and long-term rates, signalling increased risk and potential returns for long-term investments. Conversely, a flatter curve indicates lower yields, making long-term bonds less attractive.

Types of Yield Curves

Take a look at these types of yield curves:

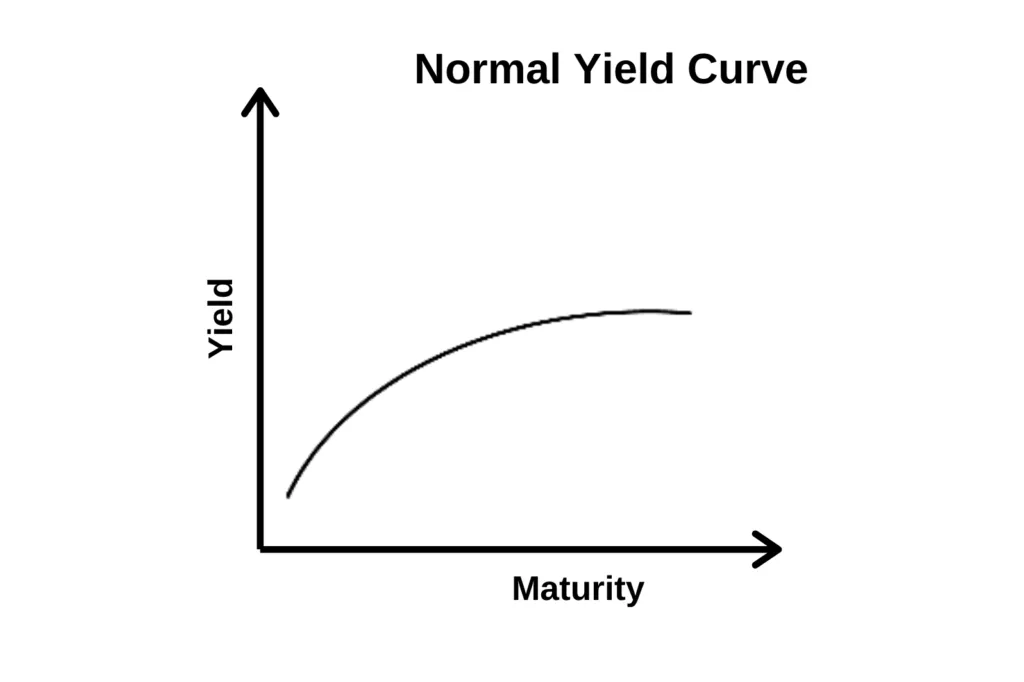

1. Normal Curve

Image Source: https://cdn.corporatefinanceinstitute.com/assets/normal-yield-curve-1-1024×682.png

A normal curve means that long-term bonds offer higher yields and short-term bonds offer lower yields. Investors typically prefer long-term investments with a positively sloped normal curve due to the increased risk and potential for higher compensation. The standard curve reflects expectations of steady growth unaffected by inflation or other factors.

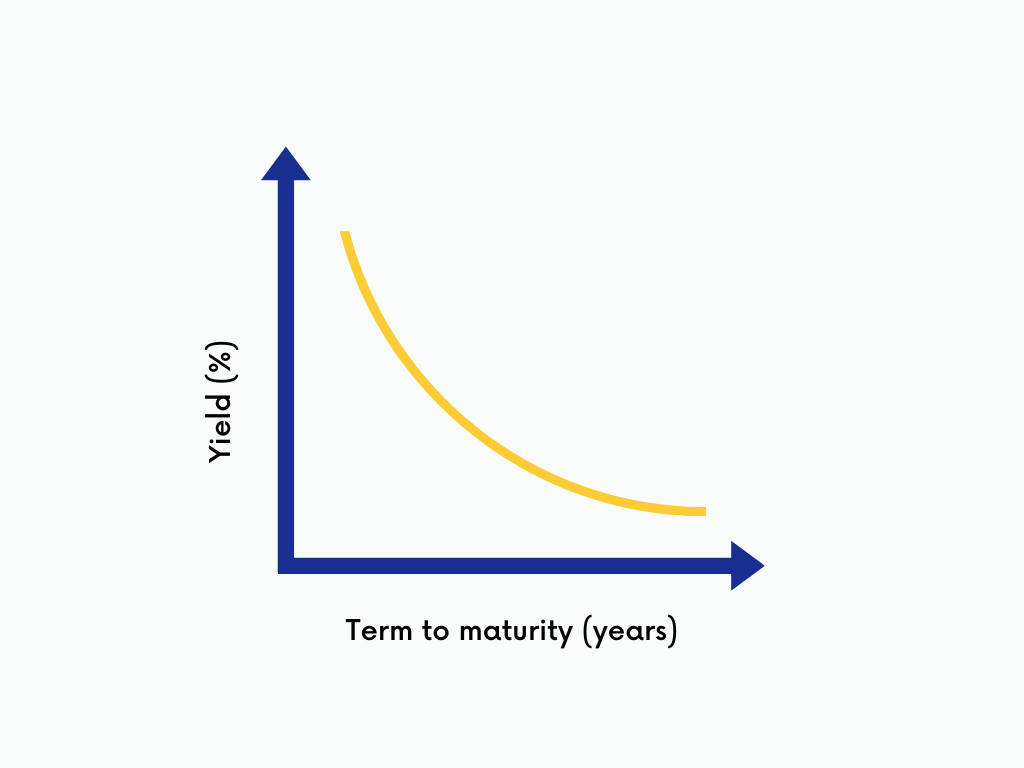

2. Inverted Curve

Image Source: https://www.moneysense.ca/wp-content/uploads/2023/03/Inverted-Yield-Curve-1024×768.png

A downward-sloping curve signals an economic recession, which reflects higher short-term returns than long-term returns. This decline is due to expectations of lower inflation, leading to reluctance of investors to get involved in short-term bonds. When the graph represents an inverted yield curve, long-term investors expect lower yields while considering it as the last opportunity to trade at current rates.

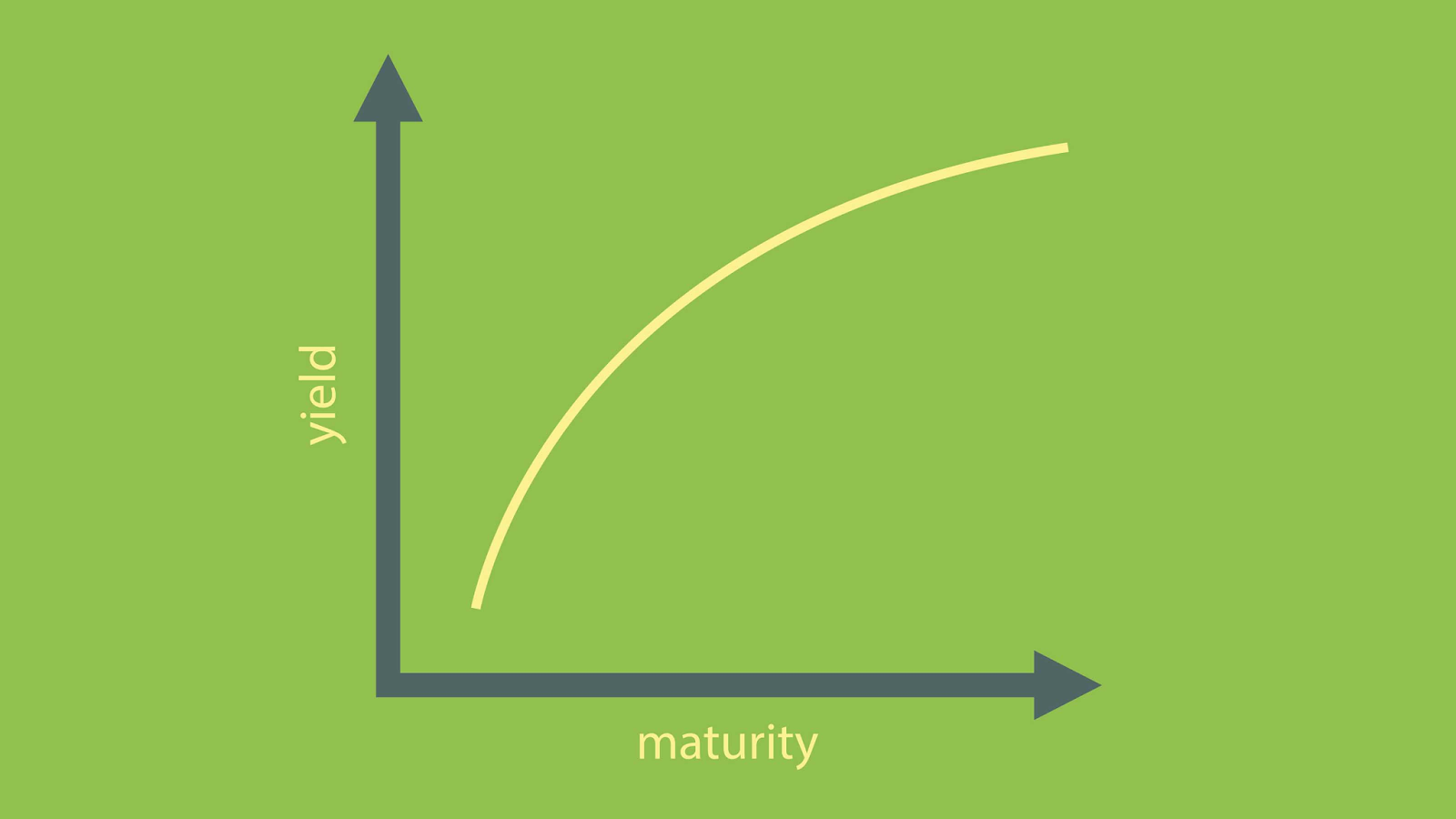

3. Steep Curve

Image Source: https://cdn.mos.cms.futurecdn.net/yzE6X6Emti7xVhYcD8B6Ha.jpg

A steep yield curve suggests optimistic long-term economic and market expectations with higher expected interest rates and inflation. It reflects increased demand for capital, which indicates economic growth after a recession. A significant difference between short-term and long-term returns implies faster growth in long-term returns. Investors respond by buying more stocks and bonds, anticipating a booming economy.

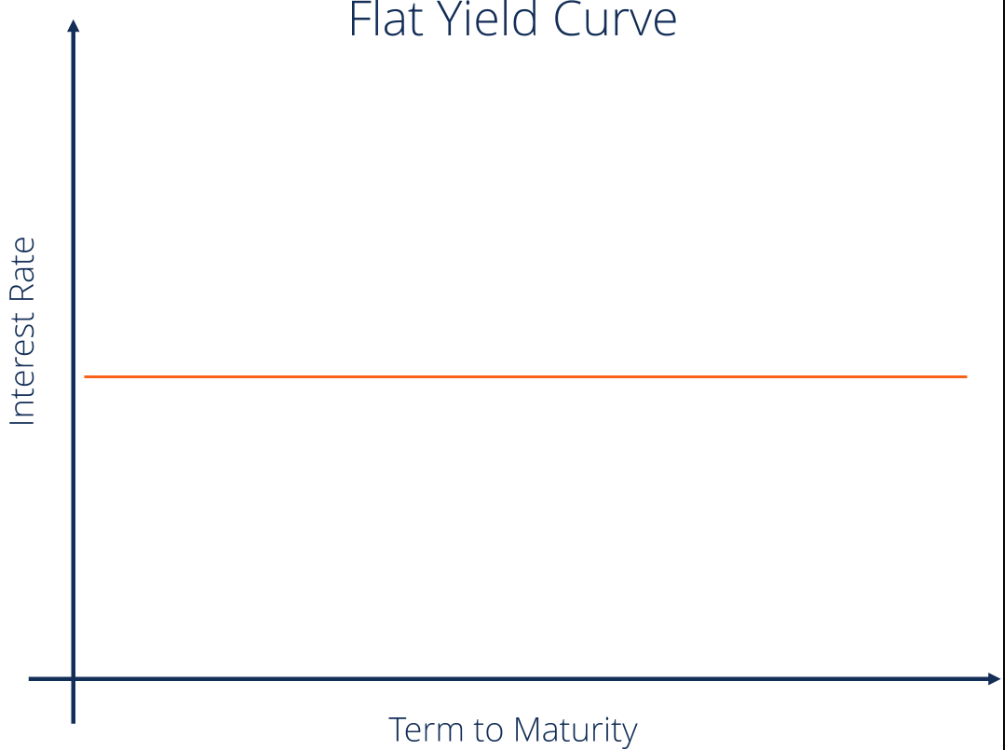

4. Flat Curve

Image Source: https://cdn.corporatefinanceinstitute.com/assets/Flat-Yield-Curve-1.png

A flat yield curve, seen between the normal and inverted curves, signals an economic transition. This suggests uniform returns across maturities, often signalling the end of a recession. This uncertainty implies parity between short-term and long-term returns, suggesting a potential economic shift.

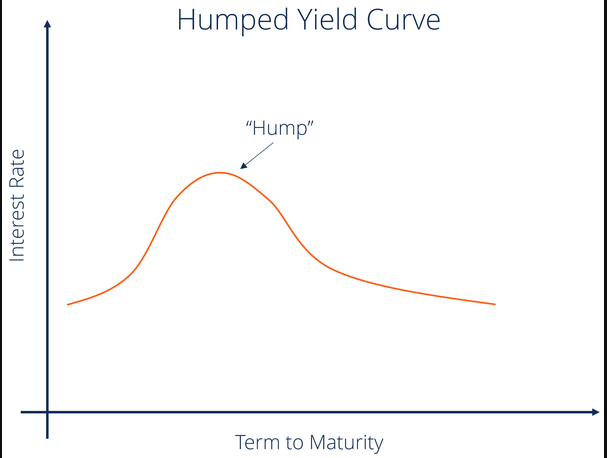

5. Humped Curve

Image Source: https://qph.cf2.quoracdn.net/main-qimg-175bedc2a33b5f4ebc18536abaeb8d51

A sloped yield curve is rare and occurs when intermediate-term bond interest rates exceed short-term and long-term bond rates. It signals economic uncertainty and slow growth. Although uncommon, it does not always precede an inverted yield curve.

Factors Impacting Yield Curve

Here are the factors impacting a yield curve:

1. Inflation

Rising inflation will prompt central banks to raise interest rates, reduce purchasing power and lead investors to expect higher short-term interest rates.

2. Interest Rate

Higher interest rates on bonds and government bonds can increase demand. Conversely, lower interest rates increase bond prices and reduce their yields. If interest rates on government securities rise, they become more attractive, causing their prices to rise and short-term interest rates to fall.

3. Economic Growth

Strong economic growth supports demand, leading to increased inflation. This growth intensifies competition for capital, offers investors more options and increases yields, resulting in a steeper yield curve.

4. Credit Rating

Rating companies assign ratings to bonds and issuers that affect bond prices. A higher rating means a lower risk of default, which affects investor confidence in the reliability of interest payments.

5. Demand and Supply of Bonds

Investors’ bond preferences are shaped by monetary policy expectations and risk perceptions. Increased demand raises the price of a bond and lowers its yield, while higher supply lowers the price and raises the yield. Preferences, expectations and supply dynamics influence bond markets.

What Is Yield Curve Risk?

Yield curve risk in investing stems from fixed-income assets such as bonds, which face reduced returns as interest rates change. The yield curve showing interest rates on bonds with different maturities poses a risk if it changes shape, especially inverts, indicating a potential economic recession. An inversion occurs when long-term interest rates fall below short-term rates, impacting investment strategies.

How to Use a Yield Curve?

The yield curve is an essential tool for investors to help them measure and predict economic performance. It guides investment decisions, with a flattening curve encouraging moves to defensive assets during economic slowdowns.

A steep curve signals potential inflation, leading investors to shy away from long-term bonds due to concerns about yield erosion.

Investors also use the curve to get financial insights, determine interest rates, and predict future rates for short-term bonds. This information influences the financial goals of an investor such as car loans and mortgages.

Conclusion

Yield curves serve as economic indicators, but they can be misleading. Media reactions to flat or inverted curves can confuse investors. It is important to view the yield curve as a snapshot, not a definitive forecast. Investors should treat them as one piece of information and make decisions based on comprehensive analysis rather than relying solely on the yield curve.

FAQs

The yield point is the state where the material shifts from purely elastic to elastoplastic deformation on the stress-strain curve, indicating the onset of permanent deformation under loading.

An inverted yield curve with short-term interest rates exceeding long-term rates is seen as a signal of an impending economic recession. This suggests a negative long-term outlook and expects further declines in long-term fixed-income yields.

The yield curve inverts when long-term interest rates fall below short-term rates, signalling investor pessimism about the short-term economic outlook.